Mediahub Names Nicole Estebanell as U.S. CEO

October 10th, 2024, New York, NY – Mediahub, an IPG Mediabrands agency that propels brands through a challenger mindset, today announced the appointment of Nicole Estebanell as its new U.S. CEO. Estebanell steps into the role after serving as Global Chief Client Officer at sister agency, Initiative, for the past two years.

Over the course of her 25+ year career in media and marketing, Estebanell has led transformation across global accounts. As U.S. CEO, Estebanell will be charged with furthering Mediahub’s position as a top media agency, overseeing its U.S. based client portfolio inclusive of leading brands like Chipotle, Netflix, the NBA and Ulta Beauty, and spearheading its next phase of growth.

“As the media landscape continues to grow in complexity and brands increasingly seek connected, data-driven capabilities, we sought to identify a U.S. leader with a dynamic breadth of experience,” said John Moore, Global CEO of Mediahub. “Nicole brings just that to the table, having helped deliver innovative, creative solutions for some of the world’s most iconic brands. I can’t think of a better person for the job.”

Estebanell’s passion lies at the intersection of media, technology, and culture, where she has spearheaded award-winning work with a focus on driving tangible business outcomes. Her leadership combines sharp strategic insight with emotional intelligence, fostering a culture of community and excellence. Estebanell is a regular on the industry speaker circuit, having taken the stage at Advertising Week New York and Cannes Lions, and has been honored some of the top accolades. She joined Initiative as it was being awarded Ad Age’s 2023 A-List Media Agency of the Year and is a recipient of She Runs It’s 2021 “Changing the Game” awards.

“I’ve long admired Mediahub given its status as the challenger agency within the IPG Mediabrands network, made even stronger by the backing of Interpublic,” said Estebanell. “John and the team have consistently delivered boundary-pushing work while nurturing a culture of innovation like no other. I’m excited to build upon that work while maintaining what makes it such a special place to make Mediahub soar to new heights.”

Sports Rights Are More Fragmented Than Ever – Who Are the Winners and Losers?

As streaming giants, traditional broadcasters and niche entrants battle over sports media rights, more viewers are watching sports than ever. Dani Benowitz, global and US president, MAGNA, explores how viewers benefit from higher-quality broadcasts and more options, while sports organizations and streaming services gain new audiences and subscribers, but the fragmented landscape poses challenges of its own.

MAGNA nudges its 2024 media spend forecast upward

IPG’s Magna unit, whose market intelligence arm regularly forecasts media spend across all media, just upped its predictions for U.S. media spend in full-year 2024, based on strong actual revenue for the first half of the year.

The agency group now expects full-year “non-cyclical ad spend,” which means not including the Olympics or political spend, will grow by 8.9% to $377 billion, one of the best performances in decades. Earlier this year, Magna was predicting 8.2% growth.

When adding in cyclical spend — and 2024 is shaping up to be a banner year for political advertising with Kamala Harris replacing incumbent president Joe Biden as the Democratic nominee earlier in the summer — Magna is predicting growth in U.S. ad spend of 11.4%. That represents an expected $10 billion in incremental ad revenue to reach $377 billion, due to the elections and summer Olympics.

Vincent Létang, Magna’s evp of global market intelligence and author of the report, credited the increase in spending estimates to a strong second quarter, which grew 11% based on his team’s analysis of media companies’ financial results.

“When we look at the economic and business environment for the rest of the year, the outlook remains positive, with GDP growing 0.8%, inflation now below 3% and unemployment staying around 4%,” explained Létang, who cited strong demand from brands in a stable economy, and supply-side innovations including the rise of ad-funded streaming and retail media. “The non-political growth rates are bound to slow in the second half due to tougher comps, specifically a very strong second half in 2023.”

Digital, of course, is where much of the growth is happening, and Magna’s analysis pointed to Google, Meta and Amazon as attracting 80% of all digital ad dollars in the U.S. Despite the aforementioned tough comps to second half ’23, Létang said he expects them to continue their strong growth rates, with percentages in the teens.

Magna’s Mike Leszega, the company’s vp of global market intelligence, analyzed other media performance for H2 2024, and found that streaming TV’s growth will more than offset a slide in ad spend on linear TV. National video ad sales in total are forecast to round out at -1.1% to around $11 billion, “the best performance in two years,” noted the Magna report.

Leszega cited 19.3% growth in ad-funded streaming, driven largely by the introduction of ads on Prime Video since January, which nearly offset the long-term erosion of linear ad revenue, which is down almost 7%. In linear, local TV is benefiting hugely from the political season, and is expected to end 2023 up 25% in ad revenue.

In the meantime, Leszega predicted other media stats: Audio (which includes terrestrial radio) will be down 3.3%, publishing will drop by 2.7% and out of home in total will grow 5.3%.

Finally, Létang and his team expect 2025 to continue the run of solid growth, when excluding the cyclical events that have pumped media’s coffers considerably this year. Magna forecasts 6.3% non-cyclical growth in 2025 to $391 billion — but when compared to political/Olympic revenue, that growth will shrink to only 3.9% above 2024.

Read the original article here.

Mediabrands Touts Global Data Integration Deal, Says It Will Simplify And ‘Turbocharge’

In the face of an increasingly complex and rapidly evolving data and technology marketplace, big agency enterprises frequently need to decide on whether to build, buy or rent next-generation solutions.

In the Age of Personalization, Acxiom’s Data and Identity Solutions Give IPG Mediabrands’ Clients a Competitive Edge

IPG Has A New Sustainable Ad Marketplace That It Says Doesn’t Sacrifice Performance

If a sustainability-focused ad product isn’t easy to adopt, measurable and good for performance, most advertisers just won’t use it.

Until recently, that was the case at IPG Mediabrands.

Although the agency holding company had a partnership with sustainability tech vendor SeenThis since 2021, only a subset of its clients took advantage of the relationship. One reason is because it wasn’t a simple process, said Sean Muzzy, global president of KINESSO, IPG’s tech and data division.

Advertisers would have to manage creative production and media planning separately to use the SeenThis offering, which reduces carbon emissions by speeding up ad delivery by streaming rather than downloading ads.

But on Wednesday, IPG announced what it’s calling a Climate Action Marketplace, built in partnership with SeenThis and PubMatic.

IPG Mediabrands clients can now simply check a box in their media plans indicating they’d like to run outstream video or display campaigns using the SeenThis tech. The supply is sold by PubMatic, and clients can use their preferred DSP. They also get access to a live dashboard that reports on carbon emissions at the campaign level.

“Audience targeting and campaign management remain unchanged,” Muzzy said, “with the added benefits of helping IPG clients reduce their carbon footprint.”

Cleaning up

This product launch comes at the heels of the Global Media Sustainability Framework announced during Cannes Lions in France last week, which was the result of a yearlong industrywide effort to introduce standards for emissions reporting.

The creation of standards for carbon measurement should also encourage more advertisers to opt into using the new climate marketplace, said Martin Bryan, global chief sustainability officer at IPG Mediabrands. Together, the framework and the new product represent a maturing of the market.

“Profit through purpose is something that’s not only possible,” Bryan said, “but something that should be made easy.”

Ad performance first

Enabling quicker ad load times achieves two things at once: improved ad performance and a related reduction in carbon emissions, said Susan Kravitz, head of commercial partnerships in the Americas for SeenThis.

When the company first launched in 2017, “our sole purpose was to deliver video and image assets into the display ecosystem [via] HTML5 to send less data over the internet,” Kravitz said, referring to the standard programming language supported by all major web browsers.

Ad performance is its core business, Kravitz said, while sustainability is “the cherry on top” that happens as part of the process. A solution isn’t sustainable from a business standpoint if it doesn’t also add to media performance, she said.

Generally speaking, when video assets render from an ad request, entire files must fully download before a video is viewable. This requires more data processing than streaming, which leads to waste and long load times, which has a negative impact on attention and, by extension, business outcomes.

In contrast, streamed ads play instantly and are more likely to capture attention, at least according to a recent study commissioned by SeenThis. The study, performed by Lumen, suggests that ads streamed by SeenThis get 1.7 times more attention than ads served using conventional tech.

For IPG Mediabrands, that proves “a direct correlation between emission reduction and attention,” Bryan said – and, in turn, return on ad spend.

IPG Mediabrands is approaching each of its clients individually to introduce the Climate Action Marketplace and explain why they should opt into using it.

Here’s to hoping for the best.

Read the full article here.

MAGNA Ups Advertising Growth Outlook Following Strong First Half of the Year

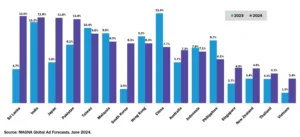

The ad economy in the Asia Pacific is forecast to grow +8.5% in 2024 to reach $289 billion. This follows growth in 2023 of +9.5%.

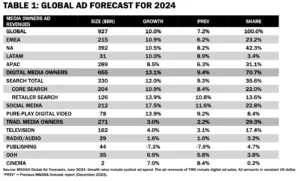

MAGNA’s “Global Ad Forecast” has released its summer update and is predicting net advertising revenues (NAR) will reach $927 billion this year, growing +10.0% over 2023.

This forecast marks a significant acceleration in the +6.4% global growth recorded in 2023 said MAGNA. Neutralizing the impact of cyclical events in 2023 and 2024, the normalized acceleration is still real but more modest: non-cyclical ad revenues grew by +7.5% in 2023 and will grow by +8.7% in 2024.

The APAC outlook – 8.5% Growth

The advertising economy in Asia Pacific will grow by +8.5% in 2024 to reach $289 billion. This follows 2023 growth of +9.5% to reach $266 billion. This is taking place in a slightly slowing, but stable, economic environment where real GDP is expected to grow by +5.2% in 2024 according to the IMF. Inflation in APAC has continued to decline and while some economies are still seeing sustained price pressures, others are facing deflationary risks. Global disinflation and the prospect of monetary easing have increased the likelihood of a soft landing.

Overall APAC growth of +8.5% in 2024 consists of traditional media owners seeing +0.8% growth to reach $68 billion (24% of budgets), and digital pure player publishers seeing growth of +11.1% to reach $220 billion (76% of budgets). Television budgets are stabilizing in 2024 and are expected to be up by +0.2% following 2023’s -2.3% performance. This increase in growth is primarily driven by the tailwinds of sporting events – primarily the Paris Olympics. The UEFA Euro 2024 tournament and other sporting events typically have only a minor impact in APAC markets.

“The digital dominance in APAC is expected to persist, with digital revenues forecast to account for 81% of total budgets by 2028, up from 76% in 2024,” said Leigh Terry, CEO IPG Mediabrands APAC.

“This shift underscores the growing importance of digital channels in reaching and engaging consumers in the region. Sri Lanka, India, and Japan are poised for significant growth in 2024, with mature markets in the region also showing signs of recovery, and contributing to the overall positive outlook for APAC.”

APAC net ad revenue growth 2023 & 2024

Key Takeaways

- The summer update of MAGNA’s “Global Ad Forecast” predicts that global media owners’ advertising revenues will reach $927 billion this year, growing by +10%.

- MAGNA is raising its 2024 growth forecast following a stronger-than-expected ad market in the first quarter (+12%) and an improvement in the economic outlook (real GDP growth +3.2%, APAC +5.2%).

- The advertising revenues of traditional media owners (TMO) – from the television, radio, publishing, and out-of-home media industries – are expected to grow to $272 billion, a +3% increase that represents a noticeable improvement compared to 2023 (-4%).

- TMO ad sales are driven by a record number of cyclical events and a +11% growth in TMO’s non-linear ad sales (e.g. ad-supported streaming +18%) that are now accounting for one quarter of total TMO ad revenues.

- The advertising sales of Digital Pure Players (DPP) will increase by +13% to reach $655 billion.

- DPP ad sales are boosted by increased competition in ecommerce, the rise of retail media networks ($146 billion this year), and better monetization of short vertical videos in video apps and social media apps.

- Keyword Search remains the largest digital ad format, growing by +12% to reach $330 billion this year. Social Media owners (e.g., Meta, TikTok) accelerate (+18% to $212bn), while short-form pure-play video platforms (e.g., YouTube, Twitch) grow by +14% to reach $78 billion.

- Among the most dynamic ad markets this year: Spain (+14%), India and the UK (both +12%), France and the US (both +11%). Germany and China are both experiencing economic difficulties and slower-than-average advertising spending (both +8%).

- The APAC ad market will grow by +8.5% this year to $289 billion. Traditional Media Owners ad sales will grow by +0.8% to $68 billion while DPP ad revenues will expand by +11.1% to $220 billion.

- Automotive and CPG/FMCG brands will be among the fastest-growing ad spending verticals this year, while Finance re-accelerates and Government expands due to the many elections taking place this year.

Busy year for cyclical events

2024 will be busy with cyclical events taking place, including four major sports tournaments (Paris Olympics, UEFA Euro 2024, Copa América hosted by the US, and the ICC T20 Cricket World Cup hosted by the US and the West Indies), and general elections in five major markets (Mexico, India, US, France, and the UK).

The first three elections take place in countries with little or no restrictions on political advertising, therefore moving the needle in terms of advertising sales.

Overall, the 2024 cyclical events will provide 1.3% extra growth to global ad revenues this year, 5% extra growth for television, 0.5% extra growth for digital media, and almost 2% extra growth for the US market alone.

“MAGNA was always expecting a strong ad market in the first quarter of 2024, due to a comp effect (1Q23 was extremely weak),” said MAGNA.

“Based on our analysis of media companies’ first-quarter financial reports, 1Q24 was even stronger than expected. Year-over-Year growth averaged +12% in key markets, +17% in Spain, +15% in France, and Germany.

It added: “Quarterly growth rates will gradually slow as comps become tougher in the second half, but this strong start of the year, coupled with a stronger economic outlook, led us to raise the full-year 2024 forecast for almost every individual market we monitor, bringing the expected global growth from +6.4% in December to +10% now. The full-year ad revenues of traditional media owners are now forecast to grow by +3% instead of +2%, and the ad sales of digital pure players are now expected to grow by +13% (previously +9.4%).

MAGNA released the following summary:

Traditional media owners (TMO), historically focusing on Television, Audio, Publishing, OOH, and cinema media, will grow ad revenues by +3% globally in 2024, to reach $272 billion. TMO’s non-linear ad sales (e.g., ad-supported streaming, digital audio, publishers’ digital ad sales) are now accounting for +25% of total TMO ad revenues and supporting advertising growth while traditional linear ad sales are stagnating.

Ad-supported streaming is taking off in 2024, as traditional TV players (e.g., Disney+, Max, ITV Hub, Joyn, TF1+, etc.) and pure streaming players (Netflix, Amazon) will generate at least $18 billion this year (+16%). Amazon has already introduced an ad-supported tier on Prime Video in most large markets in the first half of 2024, including the US, Canada, Mexico, France, Germany, Italy, Spain, and the UK. Everywhere users are defaulted to the new ad-supported tier, and MAGNA believes most users will permanently remain on that tier rather than upgrade to a more expensive ad-free tier. Other streaming platforms are introducing such ad tiers in more markets (e.g., Max in Latin America in Feb. 2024) while the rising cost of ad-free options makes the ad-supported tiers increasingly attractive.

Cross-platform television remains the largest traditional media with total ad sales reaching $162 billion this year (+4%) as media owners benefit from cyclical events and rapid growth of ad-supported streaming. Publishing ad sales will remain subdued (-3% to $44 billion) while Radio ad sales reach $29 billion (+2%). After finally catching up with the pre-COVID levels in 2023, OOH media continues to show significant organic growth (+7% to $35 billion) driven by additional screen units generating digital OOH growth (+12%, reaching almost 40% of global OOH ad sales), and by omnichannel programmatic spending.

Digital Pure-Play (DPP) media owners, offering Search/Commerce, Social, Short-Form Video, Static Banners, and Digital Audio ad formats, will reach $655 billion this year, growing by +13% over 2023, and accounting for 71% of total ad sales. DPP ad sales are fueled by multiple organic growth factors including the rise of ecommerce, the rise of retail media networks providing much-needed consumer data to the programmatic ecosystem, growing digital penetration in emerging markets, and better monetization of the rapidly growing short vertical video formats in social and video apps.

Keyword Search will remain the largest digital advertising format, reaching the $330 billion milestone driven by Retailer Search (e.g., Amazon and product listing ad retail media, +14% to $126 billion) and Core Search (e.g., Google, Bing, Baidu, +11% to $204 billion). Social Media ad sales (e.g., Meta, TikTok) will grow by 17.5% to $212 billion, while Short-Form Pure-Play Video platforms (e.g., YouTube, Twitch) will expand ad revenues by +14% to $78 billion.

Markets: India and Spain Among the Most Dynamic

According to MAGNA, the economic outlook is the primary factor behind advertising spending decisions, and economic activity is so far stronger than previously expected this year. In its April report, the IMF raised its 2024 GDP growth forecast for the world (from +2.9% to +3.2%), for the US (from +1.5% to +2.7%), for China, India, and Brazil.

“The forecast was lowered, however, for France and Germany, but as it happens, these two markets will benefit from hosting major sports events to support marketing and advertising activity. Meanwhile, inflation is slowing down everywhere and expected to hover between +2% and +3% in most large markets, which is still above the long-term target of monetary institutions but low enough to no longer hurt the sales and marketing efforts of CPG/FMCG brands,” said MAGNA.

Among the most dynamic ad markets this year: Spain (+14%), India and the UK (both +12%), France and the US (both +11%). Germany and China are both experiencing economic difficulties and slower-than-average advertising spending (both +8%).

It added that in the US, media owners’ ad revenue will increase by +10.7% to $374 billion. The US remains the largest and most intense ad market in the world, with advertisers spending $1,100 per consumer in 2024; it’s 8 times more than the global average ($160), ten times more than China ($110), and a hundred times more than India ($10).

Read the full report here.

MAGNA Raises U.S. and Global Ad Forecasts for 2024, But TV Still Expected to Decline

The media investment company now estimates that U.S. ad spending will grow to $374 billion thanks to a stronger-than-anticipated Q1.

The advertising market appears to be rebounding, but it is not equal.

The media investment company MAGNA raised its 2024 U.S. and global advertising forecast, citing “stronger-than-expected ad market in the first quarter and an improvement in the economic outlook.”

The firm now expects the U.S. ad market to total $374 billion this year (that is up from $369 billion, which it projected back in March), an improvement of nearly 11 percent year over year. The global ad market meanwhile will total $927 billion, up 10 percentcompared to last year.

The company also notes that there are a slew of major events happening around the world this year, which coukd move the advertising needle by as much as 1.3 percent.

“A record number of cyclical events are taking place in 2024, including four major sports tournaments (Paris Olympics, UEFA Euro 2024, Copa América hosted by the US, and the ICC T20 Cricket World Cup hosted by the US and the West Indies), and general elections in five major markets (Mexico, India, US, France, and the UK),” MAGNA notes. “The first three elections take place in countries with little or no restrictions to political advertising, therefore moving the needle in terms of advertising sales.”

Despite the good news, not all ad dollars are equal, and that is reflected in MAGNA’s forecast.

Traditional media owners ( Television, Audio, Publishing, OOH, and cinema media), will grow ad revenues by only +3 percent globally in 2024, to reach $272 billion, but that is skewed by the 2024 election, which will disproportionately benefit local TV stations. MAGNA says that non-poilitical TV ads are expected to decline by 4 percent and that “other traditional media will not benefit from such a massive boost.”

“National TV, Audio Media, and Publishing will be flat or down this year, and OOH will be the only other traditional media to grow ad revenues,” the report continues.

So where is the growth? Putting aside local TV, it’s in the “digital pure players” which will be up 13.5 percent. That is driven primarily by tech giants like Google, Amazon and Meta, which MAGNA estimates “now attract a combined 60 percent of total advertising revenues outside China. If you include China, where the three companies don’t operate, MAGNA estimates that they will control a mere 49 percent of global ad sales.

MAGNA’s forecast is also reflected in the ad spend among different business verticals. While food and drink and automotive sectors are seeing strong ad spending, the telecom and media sectors are classified as “slow.”

Read the full article here.

More uniformity needed to solve MFA, finds IPG Mediabrands

Agency network’s latest Media Responsibility Index also found wavering sustainability progress among both programmatic and social media platforms.

Inconsistencies in how programmatic platforms are tackling made-for-advertising (MFA) websites is impeding progress on solving the issue, according to a new report from IPG Mediabrands and its media investment unit MAGNA.

The media agency network studied for the first time how 10 ad tech firms addressed key issues within the industry — from brand safety to misinformation — as part of its latest Media Responsibility Index.

It found unified enforcement against MFA sites, a hot topic over the past year, to be “one of the largest areas of opportunity” to clean up the ad tech ecosystem, according to the report’s author Eli Harris, EVP of impact investment at IPG Mediabrands.

Of the supply-side platforms (SSPs) studied in the report, all stated that they had policies to categorize and remove MFA inventory, but their approaches and definitions varied.

“Every SSP has a different definition of what MFA sites actually are, so when it comes to the categorization or the removal, it becomes a lot harder,” said Harris.

How this inventory is filtered out of the supply chain also differs by partner; some SSPs allow buyers to opt out of buying MFA inventory by default, while others require more manual controls.

“Not only should there be an industry aligned definition of MFA, but enforcement is also something that should be standardized,” said Harris.

The evaluation is based upon a survey of five major demand-side platforms, including Amazon, Google’s Display & Video 360, The Trade Desk, Viant and Yahoo; as well as five SSPs, including Amazon, FreeWheel, Magnite, OpenX and PubMatic.

The companies completed questionnaires between January and March this year containing a list of questions about the audience and inventory controls, metrics, standards and enforcement measures they have in place. Mediabrands then ranked the partners based on how they address safety, inclusivity, sustainability and data ethics.

For the most part, it found “a lot more consistency” in how programmatic partners approach key issues versus other media categories it has studied, such as TV and social media platforms, Harris said.

MFA is a newer issue that industry bodies have yet to establish standards around. It shot to prominence in June last year after the Association of National Advertisers released a study which found MFA comprised 15% of total open web programmatic ad spend, translating to billions of dollars in waste.

In the wake of the report, many digital ad firms announced tools and partnerships to eliminate MFA inventory from ad buys. But research firm Adalytics claimed in a March report that major Fortune 500 brands were, as of January, still spending millions on this inventory as a result of enforcement failures.

Patchwork approaches to sustainability

Sustainability strategies were also identified by Mediabrands as an area for improvement among both programmatic and social media companies.

While many companies share a vision to eventually achieve net zero emissions, measurement standards and policies vary widely by partner, Harris said.

“We aren’t seeing clear and consistent definitions of what climate mis- and disinformation is, and policies to at least identify or avoid greenwashing for advertisers is something that is majorly lacking within the programmatic space as well,” Harris said.

The same issue holds true for social media platforms, where progress in identifying and monetizing climate misinformation or climate denial narratives has actually reversed.

Of the 10 platforms studied for the report, Harris said only one had a policy for identifying and demonetizing climate disinformation. A September report by the EU DisinfoLab found that only TikTok included climate change specifically in its misinformation policy; Meta and YouTube were found to have climate disinformation measures but limited enforcement.

Social media platforms studied by Mediabrands: Facebook, Instagram, LinkedIn, Pinterest, Reddit, Snapchat, TikTok, Twitch, X and YouTube.

‘Cautiously optimistic’ about election meddling

Much has changed about the Media Responsibility Index since its last public release nearly two years ago. The scope of both the companies and topics covered have expanded.

One platform in particular, which IPG Mediabrands declined to name, particularly shone in the added areas of age appropriate design and manipulated media identification and labeling.

But IPG Mediabrands declined to share specific scores for each platform or areas where certain companies excel over others, as it has in the past.

Harris said the “platform versus platform scrutiny” can “distract from the overall ambition we have with these partners — which is to improve upon their own performance year over year.”

In a critical year for democracy, with the generative AI boom threatening to disrupt elections around the world, he said he was “cautiously optimistic” about social media’s ability to rein in harm.

“There were some platforms that were a lot more advanced with their own internal systems for identification of manipulated media, and not everyone is there, but it was at least good to see that the technology and infrastructure exists to start to solve this problem in a really scalable way,” he said.

Read the full article here.